A Lens Into Our Future Office Market and the New Normal

- Charlie Farra

- May 1, 2020

- 2 min read

Does the 2001 Recession Foreshadow our Future Office Market?

"Like the 2001 recession, it will likely take 2.5 years before we see the bottom of our real estate market. Arguably more important than economics, the next 12-14 months we will see a seismic shift in how companies use office space. Traditional office use cannot exist in this environment which leaves companies with a very difficult question - How do I utilize my office ina safe and effective way in the coming years?"

(Hint... call us). Charlie Farra, NKF

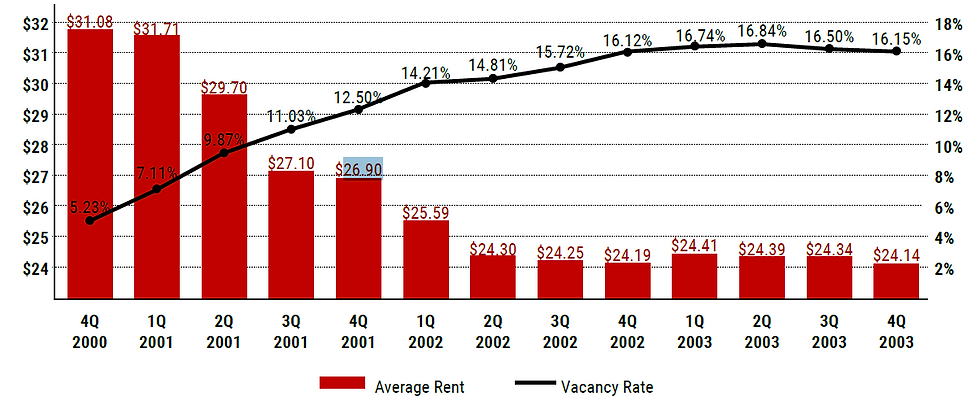

Puget Sound Office Market from 2000 – 2003

YEAR ONE - THE BEGINNING

The recession started in the 1st Quarter of 2001.

In 2000, despite warnings of a recession, developers continued forward with 2 million square feet of new office space. Today, 8.9M square feet is under construction and 63% released leaving us with 3.3M vacant.

Sublease space floods the market. Most is fallout from the dotcom bubble.

Rental rate begin to decline and concessions like free rent increase.

TAKEAWAYS

Today, Seattle's strong credit companies and fundamentals should hedge some of the sublease supply tempering our markets rental decline. However, companies like WeWork with over 1 million feet under lease may be exposed as Regus was in 2001 when they filed for bankruptcy.

YEAR 2 - A NEW NORMAL

The Puget Sound region had a strong business base with diversified companies, most of whom put their real estate decisions on hold while they waited for the economy to rebound.

Companies with lease expirations began bargain hunting as space continued to decline in price.

Investors started looking at Seattle real estate as a safe haven with incentivizing sales prices and more security than a turbulent stock market.

TAKEAWAYS

Expect our growth as a city to stall while companies navigate our new environment.

2021 may be the best time for companies to get bargain deals on office leases and upgrade into higher caliber space.

YEAR 3 - WHEN WILL THIS END

Despite economic “recovery”, limited hiring, lack of consumer spending, and an unstable stock market prevent Seattle from rebounding.

Tenants continue to upgrade. As leases expire, tenants move in superior buildings at lower rent.

2.5 years after the peak of the market, we finally see some recovery in the region.

Lack of new construction allowed second-generation space to lease. Market confidence has businesses pull back sublease space. Rents finally rebound off bottom.

TAKEAWAY

Seattle is one of the strongest regions in the world. we do not expect this recession to impact us as deeply as it will other parts of the country. Our office market also does not react as turbulently as the stock market. We do not expect a 30% drop in rent in the coming months, but there will be opportunity in the coming years.

How a company uses office space near term is arguably the most important consideration. We expect the days of density, bench seating, and shared offices are over until we reach the conclusion of this pandemic.

Comments